capital gains tax proposal details

Ad The Leading Online Publisher of National and State-specific Legal Documents. Say you make a big gain having a rate.

Part of a larger bill uncontroversially titled the American Families Plan Biden would raise taxes on the well off in a few different ways.

. If you have a 500000 portfolio be prepared to have enough income for your retirement. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. Taxes long-term capital gains and qualified dividends at the ordinary income tax rate of 396 percent on income above 1 million and eliminates step-up in basis for capital gains taxation.

Details of Biden Tax Plan. Or sold a home this past year you might be wondering how to avoid tax on capital gains. Ad If youre one of the millions of Americans who invested in stocks.

However one of the Presidents proposals is to tax long term capital gains and qualified dividends as ordinary income if your taxable income exceeds 1m. The Democrats Tax Plan Would Raise Capital Gains and Corporate Tax Rates. Monday saw the release of the Democrats full tax proposal which details their plan to pay for expanding access to paid family leave education and healthcare as well as efforts to combat climate changeThe proposal is expected to provide more than 2 trillion in new revenue over.

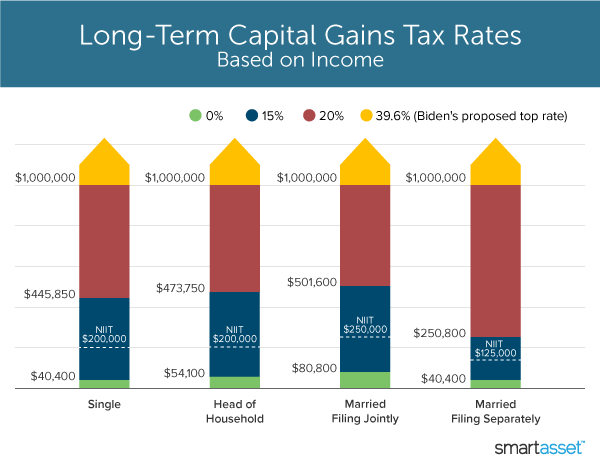

It would apply to single taxpayers with over 400000 of income and married couples with over 450000. For taxpayers with income above 1 million the long-term capital gains rate would increase to. If this happens it means they would be taxed at ordinary income tax rates as high as 396.

The new tax would affect an estimated 58000. Employee owners must have acquired capital stock while employed by the corporation for at least 10 years. Bidens campaign proposal regarding capital gainsthe details.

Learn more about the House Build Back Better Act including the latest details and analysis of the Biden tax increases and reconciliation bill tax proposals The House Build Back Better plan would result in an estimated net revenue increase of about 1 trillion 125000 fewer jobs and on average less after-tax incomes for the top 80 percent of. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or other investments and tangible assets. The new tax would affect an estimated 58000 taxpayers in the first year.

Get Access to the Largest Online Library of Legal Forms for Any State. The Biden tax plan would raise the top marginal income tax rate to 396 from the current 37 level. Under the proposal a.

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. Here are the details of Bidens plan to tax capital gains. Taxing capital gains at ordinary income tax rates would bring the combined top marginal rate in the US.

House Democrats proposed a top 25 federal tax rate on capital gains and dividends. Bidens campaign proposal regarding capital gainsthe details. Subscribe to receive email or SMStext notifications about the Capital Gains tax.

The Biden tax increases Biden budget proposal would come at the cost of economic growth harming investment incentives at precisely the wrong time. The Biden tax plan includes the following payroll tax individual income tax and estate and gift tax changes. With this new plan that rate will increase to a whopping 396--nearly double what they are paying now.

Ad Download The 15-Minute Retirement Plan by Fisher Investments. The proposal called the billionaires minimum income tax would require that taxpayers worth more than 100 million pay a minimum of 20 on their capital gains each year regardless of whether. This does not include the 38 levy on net investment income.

As it stands right now those in the high-income tax rate currently see only a 20 capital gains tax on certain assets. Qualified corporations must have done business in Iowa for a minimum of 10 years. Taxes long-term capital gains and qualified dividends at the ordinary income tax rate of 396.

Theyre taxed like regular income. To 489 percent up from 292 percent under current law and well-above the OECD average. The proposal includes top corporate and.

House Democrats outlined tax increases they aim to use to offset up to 35 trillion in spending on the social safety net and climate policy.

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Like Kind Exchanges To Be Limited Under Biden S Tax Proposals Mortgage Rates House Prices Mortgage

How To Calculate Capital Gain Tax On Sale Of Land Property In India Abc Of Money

Capital Gain Tax Ltcg Stcg Tax Rates Types And Calculation Process Tax2win

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Free Taxes Powerpoint Template

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax On Separation Low Incomes Tax Reform Group

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

How To Tax Capital Without Hurting Investment The Economist

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

How Direct Taxation Impacts The Consumer Capital Gains Tax Indirect Tax Economic Research

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

What Hsn Sac Details To Be Declared In Gst Returns Invoices Accounting Services Filing Taxes Tax Services

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World