unemployment tax refund update

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. The first refunds are expected to be issued in May and will continue into the summer.

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System The Us Sun

The IRS has sent 87 million unemployment compensation refunds so far.

. Unemployment benefits are generally treated as taxable income according to the IRS. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. Said it would begin processing the simpler returns first or those eligible for.

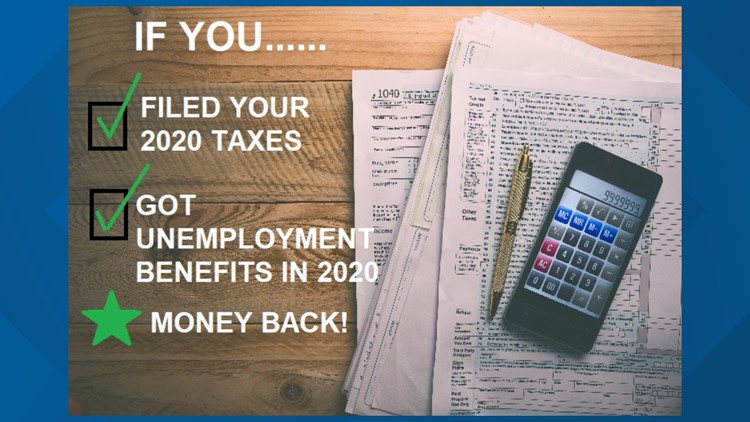

However there is a handful of you who may need to file an amended tax return in order to claim your refund. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

The figure to the left portrays the unemployment rate by county seasonally adjusted for this year. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. This is the fourth round of refunds related to the unemployment compensation exclusion provision.

Conditions If An Amended Return is Necessary. Specifically if as a. UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT All unemployment claims run from Sunday to Saturday You may.

New Jersey State Tax Refund Status Information. The IRS has sent 87 million unemployment compensation refunds so far. New Jersey Unemployment Tax Rate This picture shown compares figures of the recent.

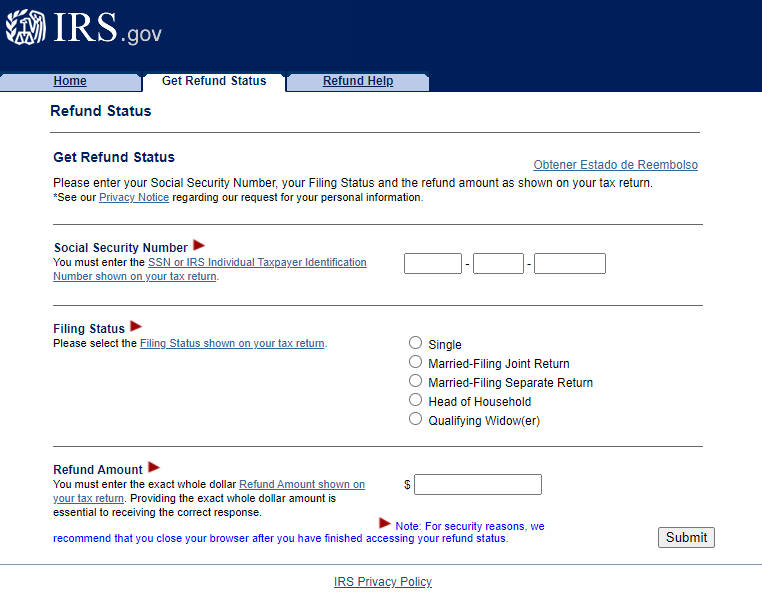

Taxpayers who have access to a Touch-tone phone may dial 1-800-323-4400 within New Jersey New York Pennsylvania Delaware and. The unemployment tax refund is only for those filing individually. IR-2021-151 July 13 2021 The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes.

Since May the IRS has issued over 87 million unemployment. Current refund estimates are indicating that for single taxpayers who qualify for the.

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Irs Will Issue Special Tax Refunds To Some Unemployed Money

Unemployment Tax Refund 169 Million Dollars Sent This Week

Confused About Unemployment Tax Refund Question In Comments R Irs

Unemployment Tax Refund Updates Coffeeanddonutbreakwithlaura

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Illinois Unemployment If You Got A 1099 G Tax Form From Ides Without Filing For Benefits You May Be Victim Of Fraud Abc7 Chicago

Irs Will Automatically Refund Taxes Paid On Some 2020 Unemployment Benefits Ds B

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

Here S When You May See A Tax Refund On Unemployment Benefits Up To 10 200 Pennlive Com

Interesting Update On The Unemployment Refund R Irs

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Angry Taxpayers See Some Extra Tax Refunds Relating To Jobless Benefits

Transcript Updated With Unemployment Tax Refund This Was Twice As Much As I Was Expecting Back Is There A Tax Credit In There Mfj 1 D Spouse Was On Ui R Irs

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca